The Russia-Ukraine War, which began with Russia’s invasion of Ukraine in February 2022, has created significant impacts in many areas, especially in food and energy. It has resulted in unprecedented economic, social, and political changes worldwide. Particularly, the grain crisis and the ‘Blacck Sea Grain Initiative Agreement,’ also known as the ‘Grain Corridor Agreement,’ have been the most significant international initiative in 2022, providing a solution to the crisis.

The agriculture sector is the only sector that produces food, and no matter how advanced technology becomes, it is not possible for another sector to produce food naturally. The agricultural sector, an area that produces essential food for people’s survival, needs to continue production during crises and wartime periods. In addition, it is necessary for the produced goods to be delivered smoothly and at reasonable prices throughout the entire supply chain from producers to consumers. In recent years, multiple crises such as climate change, pandemics, regional conflicts such as the war in Syria, and others, have caused disruptions in the flow of food from producers to consumers and have also increased problems such as rising food prices and food security. According to the Global Food Crisis Report published by the UN in early 2022, more than 190 million people were reported to be food insecure and in need of urgent assistance in 2021. It is predicted that these record levels in the world will worsen in 2022, especially with the effects of the Russia-Ukraine War. Furthermore, it has been reported that the food insecurity risk will increase due to Russia and Ukraine being the main suppliers of food aid provided by the World Food Program to poor countries.1 2

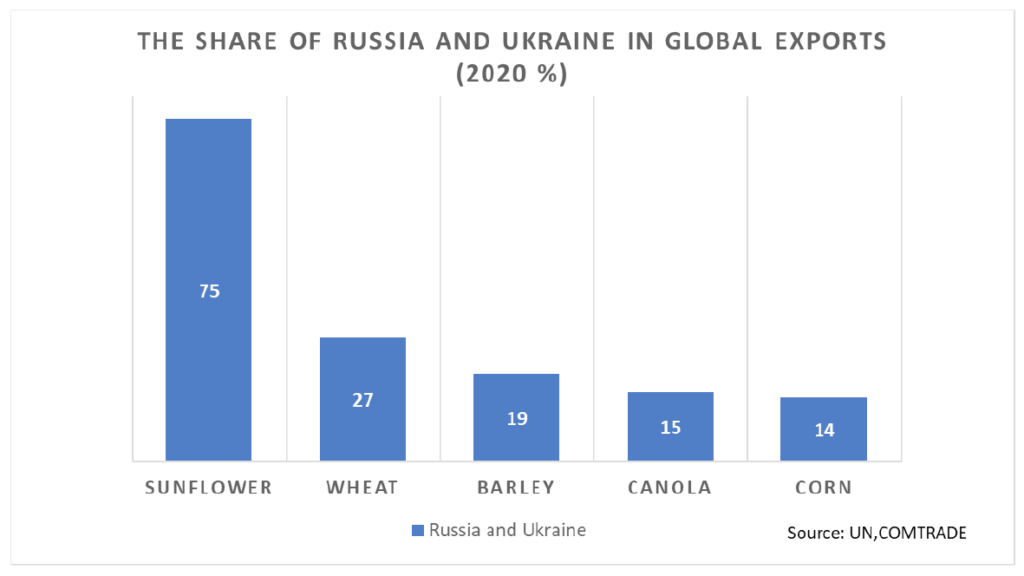

As predicted, Russia and Ukraine being major exporters in basic agricultural products and input raw materials in the global markets have put pressure on many countries in terms of agricultural products in 2022. For example, in 2020, Russia and Ukraine amounted for 75% of sunflower (sunflower seeds, sunflower oil, and meal) exports, 27% of wheat exports, 19% of barley exports and 14% of corn exports worldwide (see Graph 1). Therefore, the war has also affected global food, fertilizer, and energy prices in the world markets.

Graph 1. Share of Russia and Ukraine in Global Exports

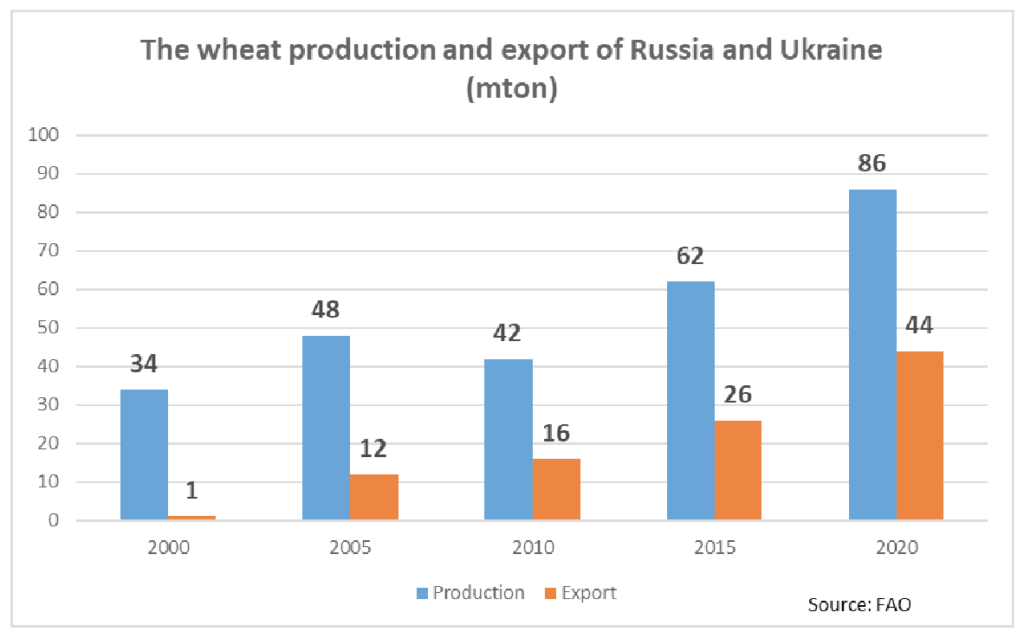

Russia and Ukraine have expanded their cultivation areas in basic agricultural products over the past decade, increasing their production and yields and gaining importance in global agricultural markets. For example, they have significantly increased wheat production, reduced their dependence on imports, and become exporting countries. In Russia, wheat production has increased from 34 million tons in 2000 to 84 million tons in 2020, while in Ukraine, it has risen from 10 million tons to 25 million tons. The total production increase, reaching 111 million tons from 44 million tons, has boosted exports. Russia has found buyers in the world market with exports reaching up to 60 million tons in some years, while Ukraine has exported up to 25 million tons (see Graph 2).3

Graph 2. Wheat Production and Export of Russia and Ukraine

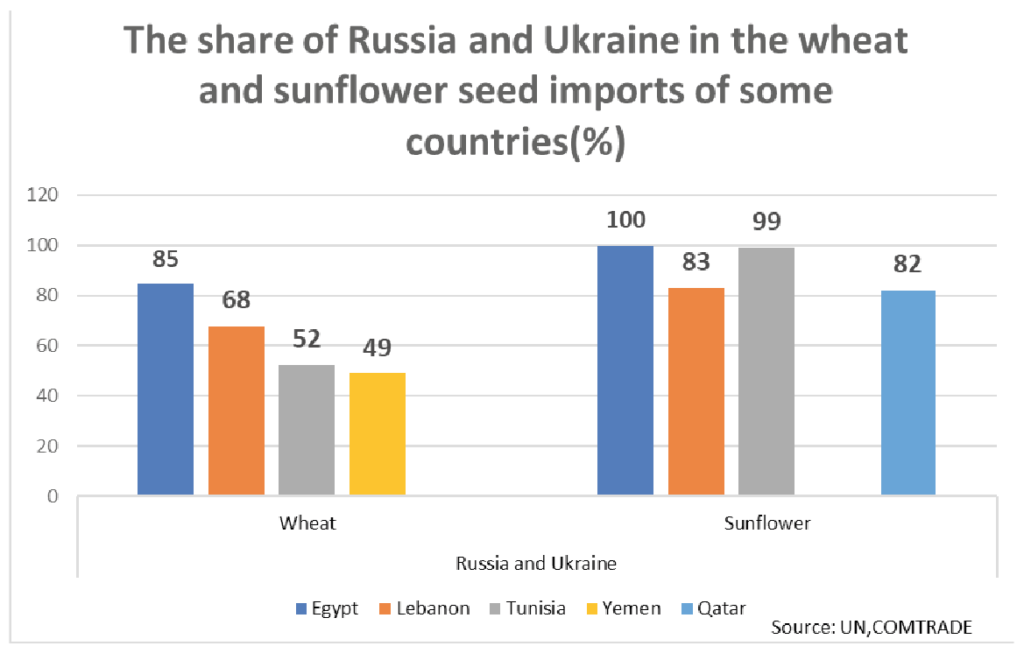

On the other hand, access to basic food is important, especially for developing countries that are dependent on imports. Many importing countries have become dependent on Ukraine and Russia for food during this process. Currently, North African, Middle Eastern, and Asian countries such as Egypt, Tunisia, Libya, Nigeria, Yemen, Qatar, and Bangladesh import a large portion of their grain needs from Russia and Ukraine. For example, Egypt, which is the world’s largest wheat importer, obtains 61% of its imports from Russia and 24% from Ukraine. Lebanon, Tunisia, and Yemen rely on these two countries for 68%, 52%, and 49% of their wheat imports respectively. In terms of sunflower seeds, Egypt is 10% dependent on Russia, Qatar is 82% dependent, Tunisia is 66% dependent, and Lebanon is 35% dependent on these two countries for imports (see Graph 3).4

Graph 3. The Share of Russia and Ukraine in Wheat and Sunflower Seed Imports in Some Countries

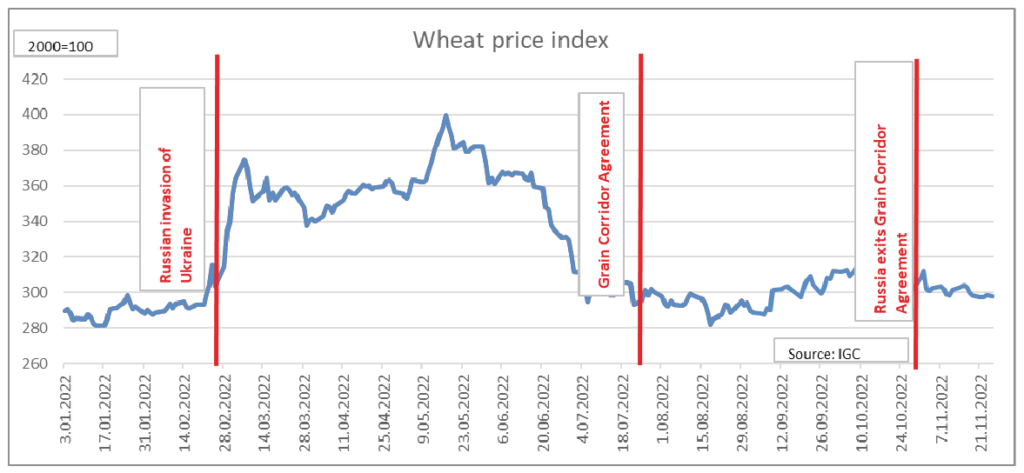

Therefore, it is predicted that the Russia-Ukraine War, which started in February 2022, will have significant effects due to the countries’ shares global markets. It has been announced that the increasing population under the threat of hunger, especially in some less developed countries dependent on imports, is a significant risk by international organizations. The increase in food prices, which already existed due to reasons such as the pandemic and climate change, has accelerated in the early days of the war, further exacerbating existing risks. According to data from the International Grains Council, the price of wheat in world markets has increased with Russia’s occupation of Ukraine. Wheat prices have experienced increases of up to 40% during the year compared to the January 2022 period (see Graph 4).5

Graph 4. Global Wheat Price Index

Effects of the Grain Corridor Agreement

Being the export leader in global sunflower exports, third in barley, fourth in corn, and fifth in wheat, Ukraine, one of the world’s largest grain exporters, normally supplies approximately 45 million tons of grain to the global market every year. However, due to the Russia-Ukraine War in late February 2022, the products remained stored in silos, and it was not possible to safely ship the grain from Ukrainian ports or use the land route safely. This situation has led to additional increase in global food prices. It has also affected fertilizer and energy prices. On July 22, 2022, the UN, Türkiye, Russia, and Ulraine signed the ‘Black Sea Grain Initiative’ in Istanbul, enabling the resumption of grain exports from Ukraine, including other food products and fertilizers, through a secure sea corridor from three important Ukrainian ports (Chornomorsk, Odessa, Yuzhny/Pivdennyi).6 7 The decrease in prices in the markets on the day the agreement was signed was considered a positive sign.

The Joint Coordinator Center (JCC), consisting of high-level representatives from Türkiye, Ukraine, Russia, and the UN, has been established in Istanbul to implement the agreement. Successful ship voyages have continued since the first ship departed from Ukrainian ports in August 2022. However, in late October, the agreement was suspended by Russia but was quickly resumed with Türkiye’s initiative.8

The developments that occurred approximately five months after the signing of the agreement are as follows:

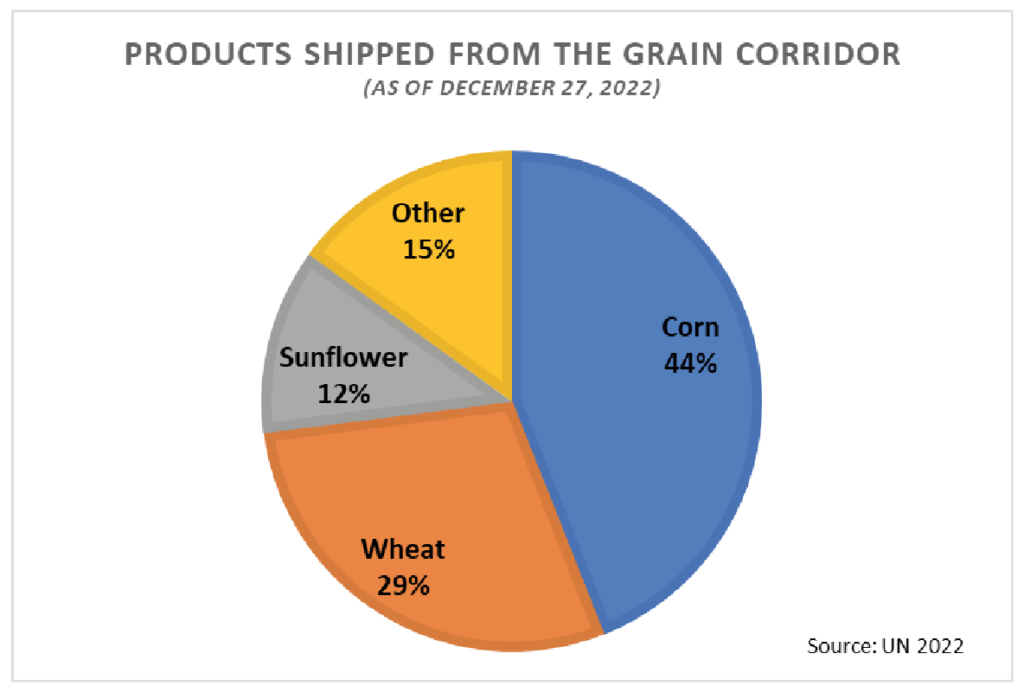

From 1 August, when the first ship set sail, until the end of the year (December 27, 2022), approximately 15.5 million tons of products have been shipped from Ukrainian ports. Among the shipped products, corn has the largest share with 44%, followed by wheat (29%) and sunflower (6%) (see Graph 5).9

Graph 5. Products Shipped from the Grain Corridor

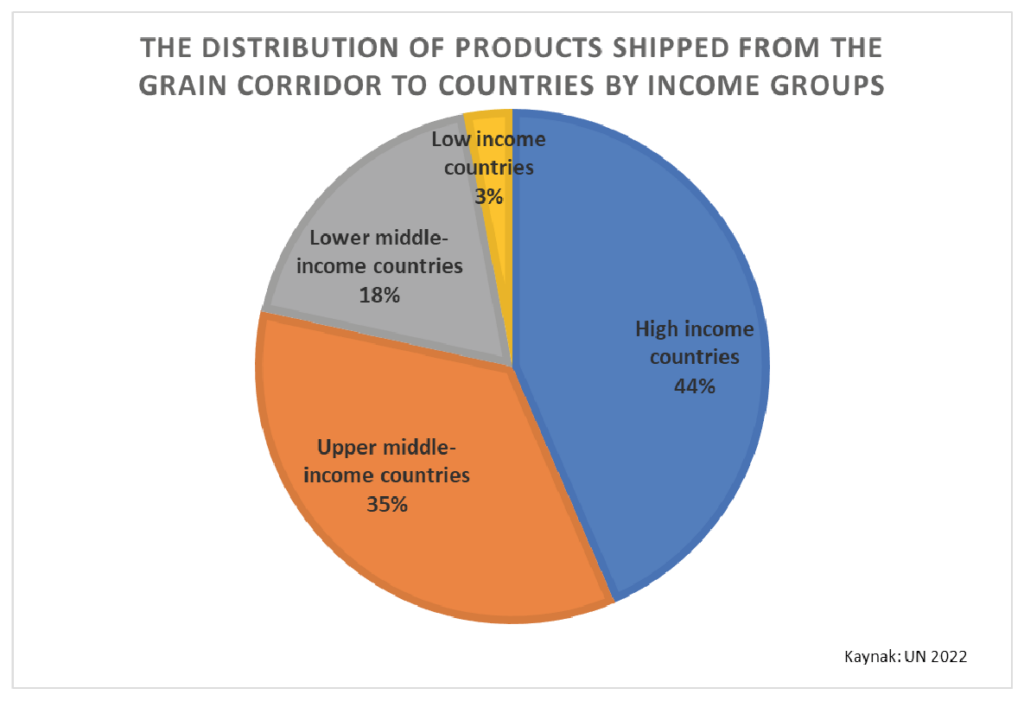

In the distribution of products shipped from the Grain Corridor to the countries reached by the ports, high-income countries have taken the largest share. Of the total shipments, 44% were made to ports in high-income countries such as Spain, the Netherlands, Italy, South Korea, Romania, Germany, France, Greece, Ireland, and Israel. The second-largest share, 35%, was taken by upper-middle-class-income countries such as Türkiye, China, and Bulgaria. Türkiye has the largest share within this group, with over 3 million tons of shipments, accounting for more than 50%. The share of the lowest-income countries was only 3%. Countries in the lower-middle-income group accounted for 18% of the share (see Graph 6).

Graph 6. The Distribution of Products Shipped from the Grain Corridor to Countries by Income Groups

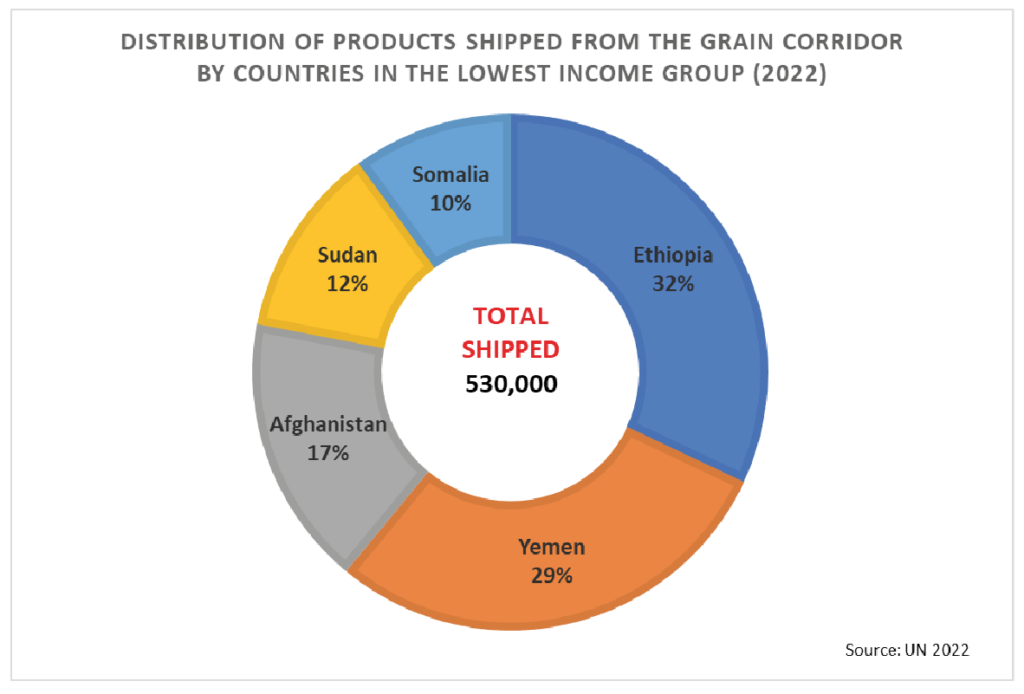

Out of the products with a shipment of 15.5 million tons in 2022, only 530 thousand tons reached the ports of the lowest-income countries, including Afghanistan, Ethiopia, Somalia, Sudan, and Yemen. Wheat constituted the entirety of the products shipped to these countries (see Graph 7).

Graph 7. Shares of Countries in the Lowest Income Group in the Grain Corridor

The countries in the middle-income group have purchased 3.2 million tons of products. Among these countries, Egypt, Dijbouti, and Bangladesh are the countries that received the highest amount of products.

Although middle and low-income countries account for 21% of the total share, it is reported that some of the products shipped to high and upper-middle-income countries are within the framework of the WFP. Four ships leased by the UN are carrying wheat purchased to support humanitarian aid in African countries, Yemen, and Afghanistan under WFP. Some of these products are also shipped to Turkish ports. The first ship leased by the WFP docked in Djibouti on August 30 to support drought relief efforts in Africa, and a second UN ship loaded with 37,500 tons of wheat arrived in Türkiye to be processed into flour. This flour will later be sent to Yemen as part of the WFP’s humanitarian aid support. The third and fourth ships leased by the WFP are also supplying wheat for humanitarian aid operations.10

On the other hand, Ukraine’s wheat exports during the January-August 2022 period amounted to 4.1 million tons. This value is half of the exports made in the same months of the previous year (87 million tons). It is estimated that due to the war in Ukraine, the area of wheat cultivation will decrease by 29% in 2023, by 35% in barley, by 14% in corn, and by 35% in sunflower. This contraction is expected to reduce Ukraine’s production by 38% in wheat, 35% in barley, 8% in corn, and 43% in sunflower.11 Keeping the Grain Corridor open will serve the continuation of both the exports of the 2022 products and the exports the products to be harvested in 2023.

Conclusion

The COVID-19 pandemic, climate change, regional conflicts (such as the Syrian crisis), migrations, and most recently, the ongoing Russia-Ukraine War since February 2022 have caused changes in global food markets.

With the ‘Grain Corridor Agreement’ signed with Türkiye’s initiatives, safe shipment from Ukraine by sea has been ensured and sustained, which has had significant effects on trade liberalization.12

The first of these reducing the risk of inadequate nutrition and hunger in developing and underdeveloped countries, preventing increases in food prices. The transported products, especially wheat, are staple food in many countries around the world. Bread and other bakery products are the largest share in daily food consumption for low-income populations developing and underdeveloped countries or within all countries. This is because their price is lower compared to other food items, and they are an essential part of the culinary culture. When evaluated in terms of the estimated impact of the ‘Grain Corridor Agreement’ in meeting the food needs of the population in developing and underdeveloped countries, it can be said that this has been fulfilled within a five-month period for some countries.

If the grain corridor had not been opened, due to Ukraine’s share in exports, there could have been a global decrease in agricultural product supply, leading to higher food prices. Not only plant products such as wheat, barley, corn, sunflower, but also prices of animal products such as meat, milk and eggs would have increased. This could have resulted in increased risk of malnutrition and hunger, especially in developing countries and low-income groups, including countries dependent on imports.

The second impact of the ‘Grain Corridor Agreement’ is to prevent social problems, including a new wave of migration. The agreement ensures that Ukrainian farmers can earn income and sustain production through grain shipments. Agricultural production is carried out on small family farms worldwide. Farmers who rely solely on agriculture as their livelihood may abandon production if their products are not sold, which can lead to various social problems, particularly economic issues and the initiation of a new wave of migration. In order to avoid such problems, the importance of the grain corridor is significant.

Its third effect is the provision of the chemical fertilizer that will be needed in future production periods worldwide. Russia accounts for 14% of global chemical fertilizer exports. Russia is the leading exporter of nitrogen fertilizers and ranks second in potassium and phosphorus fertilizer exports worldwide. The increasing trend in fertilizer prices in recent years will further rise if shipments cannot be made from Russia. The deteroriation in the global fertilizer market will have significant impacts on crop yields and farmer income. Therefore, it is important for the Grain Corridor to also serve the transportation of fertilizers from Russia. Ensuring the supply of the required fertilizer, maintaining normal yield levels, and preventing cost increases will help prevent food price hikes.

1. FAO (2021). The State of Food Security and Nutrition in the World. https://www. fao.org/publications/sofi/2021/en/

Reference ↑

2. Giray, H. (2022). Bir buğday boyu yol gidemeyiş öyküsü: Tahıl Koridoru. Tarla Sera, pp.84-89.

Reference ↑

3. FAO (2022). Food and agriculture data https://www.fao.org/faostat/en/#home

Reference ↑

4. UNCOMTRADE (2022). Welcome to the new and enhanced Comtrade https:// comtrade.un.org/

Reference ↑

5. IGC (2022). Export Prices https://www.igc.int/en/markets/marketinfo-prices.aspx

Reference ↑

6. UN (2022). Black sea grain initiative https://www.un.org/en/black-sea-grain-initiative

Reference ↑

7. EU (2022). Infographic – How the Russian invasion of Ukraine has further aggravated the global food crisis https://www.consilium.europa.eu/en/infographics/ how-the-russian-invasion-of-ukraine-has-further-aggravated-the-global-food-crisis/

Reference ↑

8. Dellal. İ. (2022). Tahıl Koridoru Anlaşması’nın 3 önemli etkisi https://www. aa.com.tr/tr/analiz/tahil-koridoru-anlasmasinin-3-onemli-etkisi/2753756

Reference ↑

9. UN (2022). Vessel Movements https://www.un.org/en/black-sea-grain-initiative/vessel-movements

Reference ↑

10. UN(2022). Karadeniz Tahıl Girişimi: Nedir ve neden dünya için önemlidir? https://turkiye.un.org/tr/201845-karadeniz-tahil-girisimi-nedir-ve-neden-dunya-icin-onemlidir

Reference ↑

11. USDA (2022). Foreign Agricultural Service. https://www.fas.usda.gov/

Reference ↑

12. Dellal. İ. (2022). Tahıl koridoru anlaşmasının 3 önemli etkisi. https://www.aa.com. tr/tr/analiz/tahil-koridoru-anlasmasinin-3-onemli-etkisi/2681015

Reference ↑